Understanding the Collaborative Practice Agreement: Essential Clauses for Independent NPs

📌 Key Takeaways

Your Collaborative Practice Agreement determines whether your independent NP practice has genuine regulatory protection or just paper compliance that crumbles under audit scrutiny.

Specialty Alignment Isn't Optional: A psychiatry-trained collaborating physician for behavioral health or an EM physician for urgent care provides meaningful clinical oversight, while generalist mismatches create legal exposure that signed paperwork won't fix.

Chart Review Vagueness Fails Audits: Phrases like "periodic review" signal weak oversight, but measurable cadences—10% monthly sampling or quarterly minimums that meet state thresholds—create defensible audit trails.

Retainer Models Reduce Risk: Monthly retainer fees for oversight services avoid the fee-splitting prohibitions and perverse incentives of per-signature arrangements, aligning collaboration around quality rather than volume.

Telehealth Requires Multi-State Clarity: Virtual care across state lines demands explicit CPA language about where both provider and patient are located, which state's rules govern each encounter, and how remote chart review and e-prescribing happen compliantly.

Service-Level Agreements Prevent Friction: Documented response times—24 hours for routine questions, immediate for urgent clinical matters—transform vague "availability" into enforceable expectations that support real-time practice needs.

Audit-ready collaboration means documented, specialty-matched oversight with measurable processes, not signature-only arrangements that look legitimate until scrutinized. Independent nurse practitioners and physician assistants launching or scaling practices in collaborative-physician states will find the framework here, preparing them for the detailed clause-by-clause guidance that follows.

Starting an independent nurse practitioner practice brings both freedom and responsibility. One document stands between your clinical vision and regulatory compliance: the Collaborative Practice Agreement.

For NPs launching telehealth services, opening urgent care clinics, or expanding into behavioral health, the CPA is more than a regulatory checkbox. It's the foundation that determines how you'll interact with your collaborating physician, what happens during chart reviews, and whether your practice can scale across state lines. When state boards audit your practice or a prescribing question arises at 9 PM on a Friday, the clarity of your CPA clauses becomes very real.

This guide breaks down the essential components of a strong Collaborative Practice Agreement—the clauses that protect your license, support quality patient care, and give you confidence as you grow your independent practice.

What a CPA Does—and Why It's More Than "Paperwork"

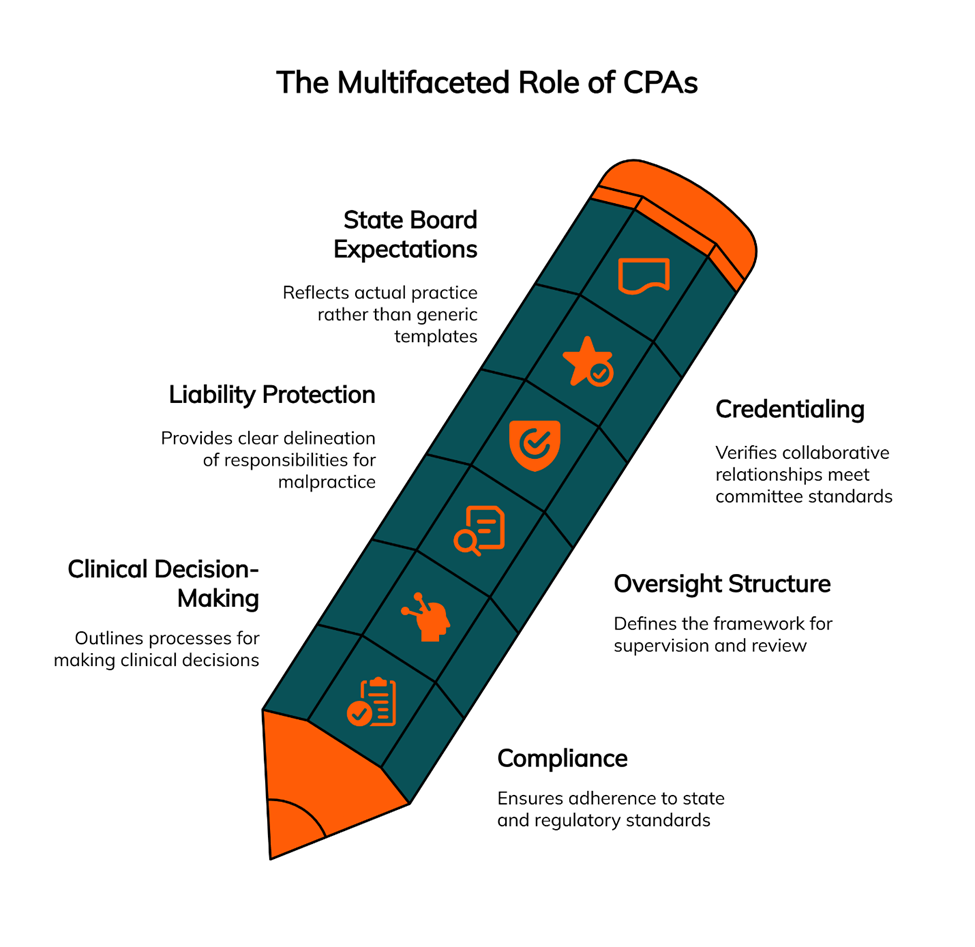

A Collaborative Practice Agreement establishes the working relationship between an NP and a collaborating physician. State practice acts vary widely—from full practice authority in some states to reduced or restricted practice environments requiring physician collaboration. Where collaboration is required, the CPA defines roles, responsibilities, and the oversight structure that keeps your practice compliant.

Think of the CPA as your practice's compliance scaffolding. It documents how clinical decisions get made, who reviews charts and how often, what happens when you need backup on a complex case, and how prescriptive authority works in your setting. States like New York have specific requirements—such as chart reviews at least every three months—while others provide more flexibility. A well-drafted agreement anticipates audit scenarios and provides documentation that you and your collaborating physician take oversight seriously.

The document also matters for liability purposes. Malpractice carriers want to see clear delineation of responsibilities. Credentialing committees review CPAs to verify your collaborative relationship meets their standards. State boards expect agreements that reflect your actual practice, not generic templates that sit in a drawer.

The Must-Have Clauses (With Plain-English Examples)

Every effective CPA includes core components that address regulatory requirements, clinical workflows, and risk management. Here's what belongs in yours.

Parties & Credentials

Start with the basics: full legal names, license numbers, DEA registrations, and board certifications for both the NP and collaborating physician. This section should specify the physician's specialty and confirm it aligns with your practice focus.

If you're running a psychiatric practice, your collaborating physician should be board-certified in psychiatry. An internist collaborating on a behavioral health practice creates clinical and legal exposure that even a signed agreement won't fully mitigate. Specialty alignment isn't just about credentials—it's about having a collaborator who understands your patient population and can provide meaningful clinical guidance.

Scope of Practice & Setting

Define where and how you'll practice. This includes physical locations, telehealth capabilities, patient populations, and the types of services you'll provide. The AANP's state practice environment framework categorizes states as full practice, reduced practice, or restricted practice. Your CPA should reflect your state's requirements and acknowledge any limitations on autonomous decision-making.

Be specific about settings. If you provide urgent care services, spell that out. Planning to offer infusion therapy or med spa services? Include those in your scope section. Many NPs start with one service line and expand later—build flexibility into the agreement so minor scope adjustments don't require a complete contract rewrite.

A plain-English example might read: "The NP will provide outpatient primary care services, including diagnosis, treatment, and ongoing management of common acute and chronic conditions, in an office-based and telehealth setting in [State]. Services will be provided in accordance with [State] nurse practice act and associated regulations."

Prescriptive Authority & Controlled Substances

This clause addresses your authority to prescribe medications, including controlled substances. Reference your state's Nurse Practice Act and any DEA requirements. Some states limit NP prescribing of certain drug schedules or require additional documentation for controlled substances.

Include language about prescription drug monitoring program (PDMP) use, which most states now mandate before prescribing controlled substances. If your collaborating physician must co-sign prescriptions or maintain oversight of specific drug categories, document those requirements clearly. Specify which drug schedules you may prescribe under state law and any restrictions on duration or quantity. Ambiguity here creates risk during board audits.

Communication & Availability

How will you reach your collaborating physician when you need guidance? This section should specify communication methods (encrypted text, phone, video conference), expected response times, and backup procedures if the primary collaborator is unavailable.

Service-level expectations matter. If you need same-day responses for urgent clinical questions, state that requirement. Many effective collaborations use tiered communication: routine questions via secure messaging with 24-hour response, urgent matters by phone with immediate callback, and scheduled video consultations for complex case reviews.

A practical example: "For non-emergent questions, the NP will contact the Collaborating Physician via secure messaging. The Collaborating Physician agrees to respond within one business day. For urgent clinical issues, the NP will call the Collaborating Physician's designated mobile number and expects immediate availability or callback within two hours."

Physician Collaborators supports encrypted text, phone, and Zoom conferences to accommodate different clinical scenarios, with clear response-time commitments built into the collaboration agreement.

Chart Review Protocols

Chart review requirements vary by state, but your CPA should document the process regardless of jurisdiction. Specify the frequency of reviews, the number or percentage of charts to be examined, and how the physician will document their review.

Some states mandate specific timeframes. New York requires chart reviews at least every three months and includes provisions for written dispute resolution. Even in states without explicit requirements, establishing a regular review cadence—such as a minimum of 10% of charts monthly, targeting higher-risk cases, or at least five charts quarterly—demonstrates active oversight.

Document how charts will be transmitted securely, how feedback will be provided, and what happens if the review identifies concerns about clinical decision-making. Create an audit trail. When state boards investigate a complaint, they'll ask for proof of ongoing collaboration—not just a signed agreement from two years ago.

Quality Assurance & Escalation

Define how you'll handle quality assurance, peer review, and situations that require physician involvement. This includes adverse events, patient complaints, complex diagnostic challenges, and cases outside your typical scope.

Specify escalation procedures. At what point does a case require direct physician consultation or patient transfer? How will you document these interactions? Consider including metrics you'll track, such as medication errors, readmissions, or patient satisfaction scores. Building clear pathways for escalation protects both you and your patients—and demonstrates that collaboration means more than a signature on letterhead.

Telehealth Modality & E-Prescribing

If you provide telehealth services, your CPA needs specific language addressing remote care. Identify which states you're licensed in and where patients may be located during virtual visits. Note that both provider and patient location matter for licensure compliance—practicing via telehealth typically requires licensure in the state where the patient is physically located.

Address e-prescribing workflows, documentation standards for virtual visits, and protocols for situations requiring in-person assessment. Some states restrict telehealth prescribing of controlled substances or require an initial in-person visit. Your agreement should acknowledge these limitations and establish clear protocols. Document which technology platforms you'll use for video visits and e-prescribing, how you'll verify patient identity and location, and how telehealth charts are stored and shared with your collaborating physician.

HIPAA/Privacy & Data Retention

Document how you'll share patient information with your collaborating physician while maintaining HIPAA compliance. Specify secure transmission methods for chart reviews, establish data retention requirements, and clarify each party's responsibilities as covered entities.

Include provisions for audit documentation. State boards may request collaborative agreement records years after the fact. Establish retention timelines that protect both parties and meet regulatory requirements—typically at least seven years for medical records and collaboration documentation.

Training & Competency

Address initial onboarding and ongoing professional development. How will the collaborating physician assess your clinical competency in your practice area? What continuing education expectations apply to both parties to maintain expertise in evolving standards of care?

This clause reinforces that collaboration involves active engagement, not passive oversight. It can include provisions for case-based learning, review of current literature, or attendance at relevant conferences. Tie these expectations directly to your specialty focus—behavioral health, urgent care, infusion therapy, or whatever services you provide.

Malpractice Coverage & Indemnification

Both parties need appropriate malpractice insurance. Your CPA should specify coverage amounts, require proof of insurance, and establish notification procedures if either party's coverage lapses or changes.

Indemnification clauses define financial responsibility if legal claims arise from patient care. These provisions can be complex and often benefit from legal counsel to ensure they're enforceable and fair to both parties. Many collaborating physicians want confirmation that NPs carry their own coverage and that the CPA does not create an employer-employee relationship unless that's intended.

Term, Payment, and Termination

Specify the agreement's duration, renewal process, and compensation structure for the collaborating physician's time and oversight. Be clear about notice periods for termination—30, 60, or 90 days is common—and include provisions for maintaining continuity of care if the collaboration ends.

Modern collaborative arrangements typically use retainer-style monthly fees rather than per-signature or per-chart fees. This structure reduces administrative burden and aligns incentives around quality oversight rather than volume. Without adequate notice periods, NPs risk practice disruption if a collaborator suddenly terminates the relationship. Build in time to find a replacement and transfer oversight smoothly.

Dispute Resolution & Governance

Establish procedures for resolving clinical disagreements between the NP and physician. New York's regulations provide a specific example, requiring written protocols for resolving differences of opinion about patient care. Even without state mandates, including dispute resolution language demonstrates mature professional collaboration.

Specify which state's laws govern the agreement and whether mediation or arbitration will be used before litigation. Define stepwise dispute-resolution steps: discuss the issue, document the disagreement and resolution, adjust protocols if needed. These provisions may never be needed, but when disagreements arise, having a clear process prevents destructive conflicts.

Financial Relationship Compliance

Some states restrict financial arrangements between NPs and collaborating physicians. New York, for instance, prohibits fee-splitting arrangements where physicians receive a percentage of the NP's collections. Your CPA should address payment structure and confirm compliance with state prohibitions on improper financial relationships.

This protects both parties from accusations of unlawful fee-splitting or kickbacks. Even well-intentioned arrangements can cross regulatory lines if not structured carefully. Clear documentation that compensation is for oversight services, not patient volume or revenue sharing, helps maintain compliance.

Optional but High-Impact Clauses That Reduce Audit Risk

Beyond state requirements, certain provisions strengthen your CPA and demonstrate professionalism during credentialing or audit scenarios.

Documentation Checklist: Include an appendix listing what records you'll maintain—signed CPA and updates, logs of chart reviews with dates and findings, communication logs for escalated cases, protocols and standing orders, telehealth workflows—and where you'll store them. This checklist serves as your audit preparation roadmap.

Service-Level Expectations: Define response time tiers beyond basic availability. A three-tier system works well: routine clinical questions within 24 business hours, urgent clinical issues with same-day response, and emergency matters requiring immediate phone availability. Documenting these expectations prevents frustration and ensures clinical support matches your practice needs.

Specialty Alignment Addendum: For practices in behavioral health, urgent care, infusion therapy, integrative medicine, or med spa services, consider an addendum that specifically addresses clinical protocols, patient populations, and specialized oversight needs unique to that setting. This reinforces specialty-matched collaboration and documents domain expertise.

Common Pitfalls (and How to Avoid Them)

Certain CPA mistakes appear repeatedly and create unnecessary risk.

Signature-Only Agreements: The most common failure mode involves agreements that look professional on paper but lack substance in practice. No documented chart reviews, no actual consultations, no evidence of ongoing collaboration. State boards recognize signature-only arrangements instantly. They don't satisfy regulatory requirements and leave both parties exposed. The hidden risks of informal supervisory agreements include license discipline, claim denials, and credentialing problems.

Mismatched Specialties: Using an available physician rather than the right physician creates clinical and legal exposure. A family medicine physician collaborating on a psychiatric NP practice may sign charts, but lacks the specialized knowledge to provide meaningful oversight. Speed in matching shouldn't increase collaboration risk—taking time to find specialty-aligned collaboration prevents problems later.

Ambiguous Chart Review Language: Phrases like "periodic review" or "as needed" don't meet regulatory scrutiny. Specify measurable cadences—review of at least 10% of charts monthly, quarterly review of a minimum of five patient encounters, or whatever standard fits your practice volume and meets or exceeds state minimums. Document actual dates and findings. Ambiguity suggests lack of genuine oversight and becomes indefensible during audits or depositions.

Telehealth-First CPAs: Clauses for Virtual Care

Telehealth introduces operational complexity that traditional CPAs don't address. If you're building a virtual practice, your agreement needs specific provisions.

Multi-State Operations: Operating across state lines requires careful attention to licensure in each state where patients are located. The NCSBN's APRN Consensus Model provides regulatory framework, but individual state requirements vary significantly. Your CPA should acknowledge multi-state practice and confirm the collaborating physician's willingness to provide oversight across those jurisdictions. Consult AANP's state practice maps before expanding to new states to understand collaboration requirements in each location.

E-Prescribing Protocols: Document your e-prescribing platform, DEA compliance for controlled substances, and how prescription monitoring programs will be accessed. Include procedures for situations where electronic prescribing isn't available or appropriate, and specify extra safeguards for controlled substances in telehealth settings.

After-Hours Coverage: Virtual care often extends beyond traditional office hours. Define availability expectations and backup procedures when you're off duty. How will urgent patient needs be handled nights and weekends? Who covers the collaborating physician when they're unavailable?

Remote Documentation: Specify how virtual visit notes will be shared for chart review, how the physician will document oversight in telehealth records, and what audit trail you'll maintain for collaborative consultations conducted via video or phone. Make sure your operational workflows align with what's written in the CPA.

CPA vs. Medical Director: What the Agreement Covers (and What It Doesn't)

Many NPs confuse the role of a medical director with that of a collaborating physician. These positions serve different functions. A medical director handles policy, protocols, and organizational governance, while a collaborating physician provides clinical oversight required by state boards for NP practice authority.

One doesn't replace the other. An NP in a reduced-practice state needs a collaborating physician regardless of whether the organization also employs a medical director. The CPA addresses individual clinical oversight and regulatory requirements, not organizational leadership. If your physician wears both hats, clarify which role they're fulfilling in each context and consider separate agreements for each function.

Build vs. Buy: Template, Counsel, and a Collaborating Network

Many NPs start with CPA templates, which serve as useful frameworks. New York provides a sample collaborative agreement that illustrates the components state regulators expect to see. Templates give structure but require customization for your specific practice, state requirements, and clinical setting.

Legal counsel becomes essential when addressing liability provisions, indemnification language, complex multi-state arrangements, or when significant financial interests are at stake. An attorney familiar with healthcare regulations in your jurisdiction can identify state-specific requirements and ensure your agreement is enforceable.

The harder challenge often isn't the paperwork—it's finding a collaborating physician whose specialty matches your practice focus, who understands the oversight model, and who will engage actively rather than treat collaboration as passive income. Physician Collaborators connects independent NPs with board-certified internists, family medicine physicians, emergency physicians, and psychiatrists experienced in collaborative practice. We support general medicine, behavioral health, telemedicine, urgent care, infusion therapy, integrative medicine, and med spa practices across 40+ states.

We match specialty to practice setting, establish clear service-level expectations from the start, and provide audit-ready processes—encrypted messaging, scheduled chart reviews, documented consultations—that demonstrate genuine collaboration. Matching typically completes within about a week. Inquiries receive responses within 24 hours.

Grow with specialty-matched, board-certified collaborators supporting telehealth, urgent care, behavioral health, infusion therapy, integrative medicine, and med spa services. Explore our services.

Quick CPA Checklist

Use this checklist when reviewing or drafting your Collaborative Practice Agreement:

[ ] Parties identified with licenses, DEA, board certifications specified

[ ] Physician specialty aligns with NP practice focus

[ ] Scope of practice and settings clearly defined

[ ] Prescriptive authority and controlled substance protocols documented, including PDMP use

[ ] Communication methods and response time expectations established (e.g., 24-hour routine, immediate urgent)

[ ] Chart review frequency and sampling method specified with measurable cadence (e.g., 10% monthly minimum)

[ ] Quality assurance and escalation procedures defined

[ ] Telehealth and e-prescribing provisions included (if applicable)

[ ] HIPAA compliance and data retention requirements addressed

[ ] Training and competency expectations documented

[ ] Malpractice coverage requirements specified with notification duties

[ ] Term, compensation structure (retainer vs. per-signature), and termination notice periods established

[ ] Dispute resolution procedures defined with governing law specified

[ ] Financial relationship compliance confirmed (no prohibited fee-splitting)

[ ] Service-level expectations documented with tiered response times

[ ] Specialty-specific protocols included (for BH, urgent care, infusion, etc.)

Frequently Asked Questions

How quickly can I be matched with a collaborating physician?

Matching typically completes within about a week once you provide necessary details—degree, states, malpractice coverage, practice type, controlled substances status, and NPI. Actual timing depends on your specialty and state requirements. We prioritize finding the right specialty match rather than simply the fastest available physician.

How do we interact day to day?

Collaborative relationships work through encrypted text messaging, phone calls, and scheduled Zoom conferences depending on the situation. Routine questions receive responses within 24-48 hours. Urgent clinical matters get same-day attention. Regular chart reviews and consultations establish ongoing oversight. Your CPA should make these expectations explicit so everyone knows how to reach each other.

What does monthly oversight actually look like?

Active collaboration includes regular chart review—typically a sampling of your patient encounters each month or quarter, with feedback documented. You'll have scheduled meetings or async reviews to discuss higher-risk cases. Occasional protocol updates based on what you both see in practice keep the collaboration current. Secure chart upload makes documentation sharing straightforward. The key is that your paper trail matches your actual workflow.

What will collaboration cost?

Fees vary based on state and regulatory complexity, specialty (high-risk med spa versus low-acuity primary care), and expected workload such as chart-review volume and telehealth reachability. NPs commonly see ranges in the $500 to $1,250 monthly band for structured, retainer-style collaborations rather than per-signature fees. We provide transparent pricing during initial consultations.

What if I need collaboration in multiple states?

We support NP practices across more than 40 states, including New York, New Jersey, and Pennsylvania. Multi-state arrangements require careful attention to each jurisdiction's requirements. Consult AANP's state practice resources to understand collaboration requirements before expanding to new locations. Collaborative agreements can be structured to accommodate telehealth practices serving patients in multiple states.

Is this article legal advice?

No. This article is for educational purposes only and is not legal advice. CPA requirements vary by state and change over time. Always consult state law, current resources such as AANP's state practice maps and NCSBN guidance, and qualified legal counsel licensed in your jurisdiction.

Let's finalize your CPA and launch with confidence. Book your free consultation—we'll reply within 24 hours and typically match you with a specialty-aligned collaborator within about a week.

The collaborative relationship you establish today shapes your practice's trajectory for years to come. Invest the time to build an agreement that supports both regulatory compliance and clinical excellence. When your CPA reflects genuine collaboration—specialty-matched oversight, clear communication protocols, documented chart reviews, and audit-ready processes—you practice with confidence knowing your foundation is solid.

Our Editorial Process: We prioritize state statutes, state board guidance, NCSBN resources, and HHS materials. Every statement that could affect compliance is checked against authority sources and dated. We avoid vendor/competitor sources for definitions and requirements. Articles receive a legal/compliance pass for clarity before publication.

About Physician Collaborators Insights Team

Physician Collaborators is a network of board-certified physicians actively practicing Internal Medicine, Family Medicine, Emergency Medicine, and Psychiatry. Each collaborating physician has over a decade of experience supervising nurse practitioners and physician assistants. Our mission is to help advanced practitioners succeed in their independent medical practices through specialty-matched, audit-ready collaboration. Learn more about our approach.

344 Grove St, Unit 1082

Jersey City, NJ 07302

United States